Which of the Following Are Ways to Amortize a Loan

Pay principal and interest every period in a fixed payment. If you have a lot of monthly cash flow and you want to save on.

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

And you may be able to adjust payments in other ways.

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

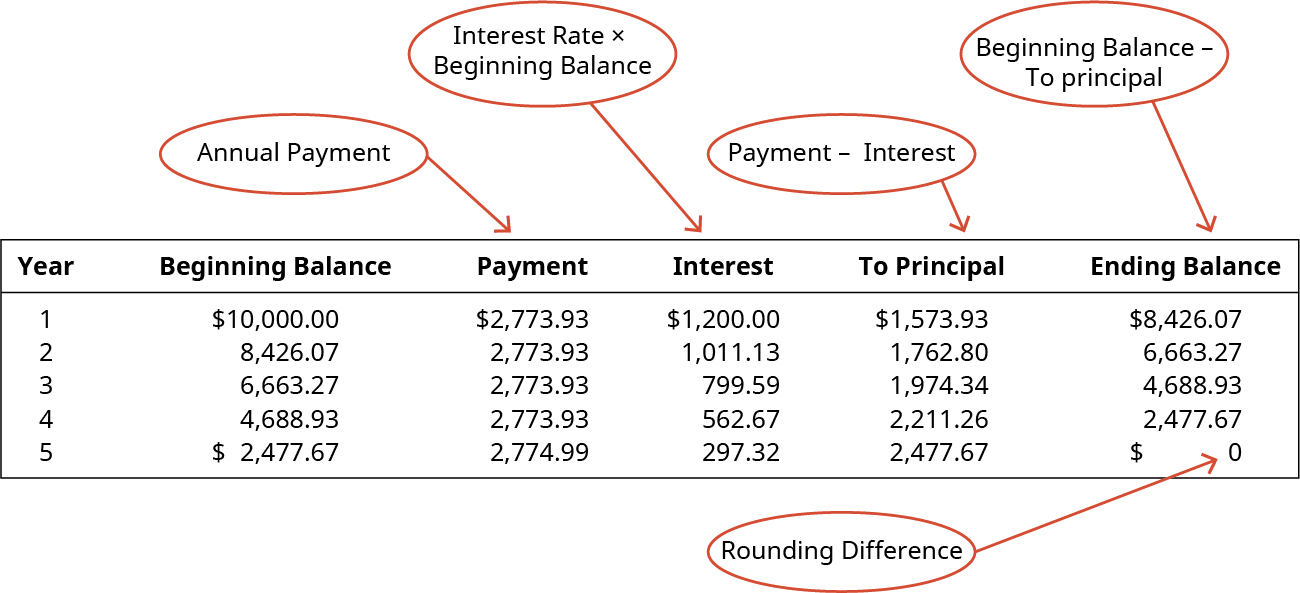

. Starting in month one take the total amount of the loan and multiply it by the interest rate on the loan. Pay the interest each period plus some fixed amount of the principal. C An amortized loan will have a lower payment than an interest-only loan holding everything else the same.

The concept of amortization arises because a loan is usually long-term and does not relate to a single current accounting period. Round your answers to the nearest cent 4000 9 12 4 years a Find the monthly payment. Pay the interest each period plus some fixed amount of the principal.

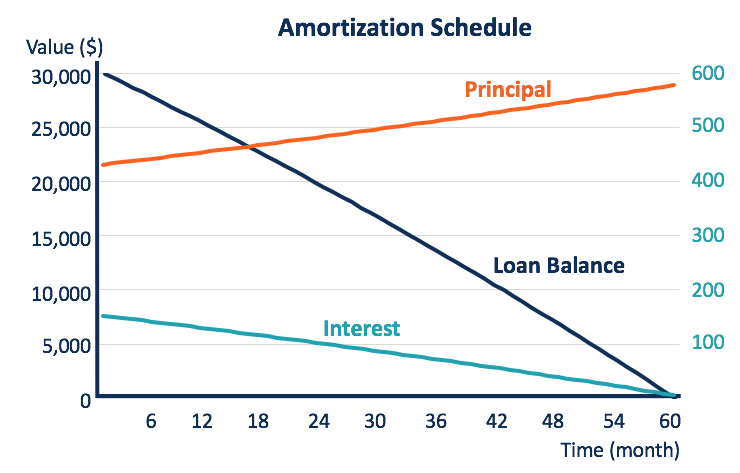

The loan is paid off at the end of the payment schedule. The decision between a short- or long-term loan should depend on your personal finances. Amortization is the process of spreading out a loan into a series of fixed payments.

Pay principal and interest every period in a fixed payment. -pay principal and interest every period in a fixed payment -pay the interest each period plus some fixed amount of the principal. Which of the following are ways to amortize a loan.

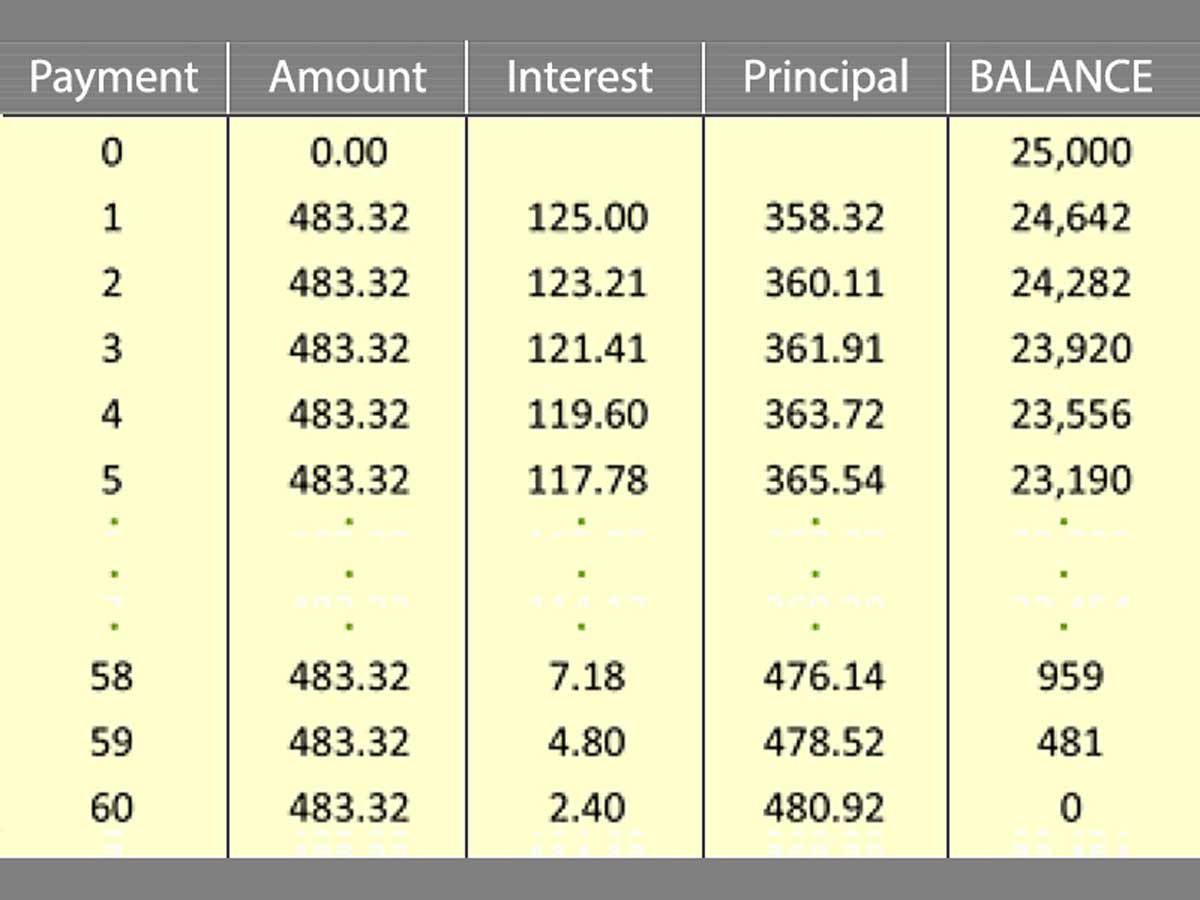

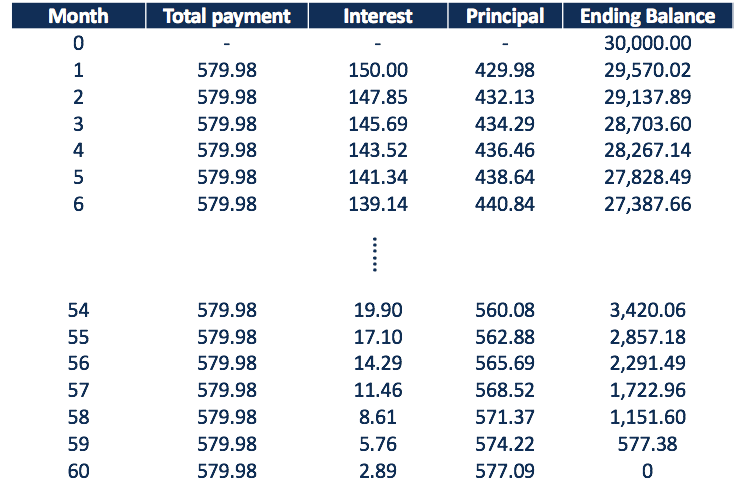

Which of the following are ways to amortize a loan. The final payment is a balloon payment. The following table shows an abridged example of an amortization schedule for a 200000 30-year fixed-rate loan at a 45 interest rate.

Which of the following are ways to amortize a loan. Most mortgages are amortized loans but others work in different ways. Key Learning Points Loan amortization refers to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full by its maturity date.

B Find the total interest. A With an amortized loan each loan payment contains some payment of principal and an interest payment. A portion of each loan payment will go towards the principal of the loan and the remainder will go towards interest charges Interest Expense Interest expense arises out of a company that finances through debt.

Round your answers to the nearest cent 4000 9 12 4 years a Find the. Which of the following is equal to an effective annual rate of 1236 percent. All of the following statements are true about a partially amortized loan except.

The amortization of the fees helps to ensure that cost is allocated to the periods in which benefit is obtained from the loan. The common types of loans that can be amortized include auto loans student loans home equity loans personal loans and fixed-rate mortgages. Or enter in the loan amount and we will calculate your monthly payment.

Hence as per the matching concept the loan should be amortized over the life of the loan. An amortized loan is one where the principal of the loan is paid down according to an amortization schedule typically through equal monthly installments. You can use the following Amortized Loan Formula Calculator.

The following loan is a simple interest amortized loan with monthly payments. Its relatively easy to produce a loan amortization schedule if you know what the monthly payment on the loan is. The following loan is a simple interest amortized loan with monthly payments.

Over time you pay less in interest and more toward your balance. Interest-only loans for instance only require you to pay the interest on the loan for a certain amount of time. This is great during the initial period when just the interest is due as it results in much lower payments.

To amortize a loan refers to equal and periodic payments monthly in most of the cases on which the lender runs some interest ratio due to the amortization. Amortized Loan Formula Calculator. B Amortization refers to the way the borrowed amount principal is paid down over the life of the loan.

A partially amortized loan is a self-liquidating loan. In other words it means that the total amount of money the lender is going to give you is divide in smaller amount of moneys which he is gonna lend you periodically monthly. The periodic payments do not fully amortize the loan by the end of the term.

Some of each payment goes towards interest costs and some goes toward your loan balance. Interest is being paid throughout the term. You can then examine your principal balances by payment total of all payments made and total interest paid.

Then for a loan with monthly repayments divide the result by 12 to get your monthly interest. Enter your desired payment - and let us calculate your loan amount. Nowadays most of the loans are amortized loans such as personal loans home loans auto loans etc wherein the equated amount of payment is made over an extended period of time 5 years to 30 years.

Instance Of Amortization Schedule By Means Of The Annuity Algorithm Download Scientific Diagram

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Instance Of Amortization Schedule By Means Of The Annuity Algorithm Download Scientific Diagram

Amortizing Loan Overview How It Works Loan Types

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

What Does Zero Amortization Mean Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Amortization Turns Asset Costs Into Expenses Or Pays Off Debt

Compute Amortization Of Long Term Liabilities Using The Effective Interest Method Principles Of Accounting Volume 1 Financial Accounting

Amortization Schedule Overview Example Methods

Amortization Schedule Overview Example Methods

Amortization Schedule Loans And Calculations

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Comments

Post a Comment